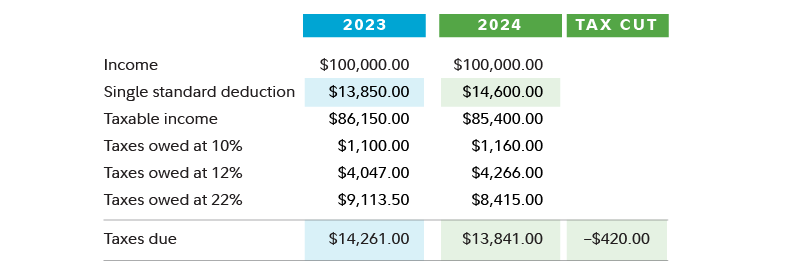

Schedule A Standard Deduction 2025 Single – The standard deduction reduces the amount of your taxable income—the IRS has increased it in 2023 and 2025, which could result in a lower tax bill for many Americans. . With tax season underway, you’ll need to know the standard deduction amount you can claim for 2023. The standard deduction amounts tend to increase slightly each year to adjust for inflation. Let’s .

Schedule A Standard Deduction 2025 Single

Source : www.forbes.comAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.comYour First Look At 2025 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com2025 IRS Tax Brackets and Standard Deductions Optima Tax Relief

Source : optimataxrelief.comYour First Look At 2025 Tax Rates: Projected Brackets, Standard

Source : www.forbes.comIRS Tax Brackets 2025, Federal Income Tax Tables, Inflation Adjustment

Source : www.nalandaopenuniversity.comYour First Look At 2025 Tax Rates: Projected Brackets, Standard

Source : www.forbes.comProjected 2025 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.comIRS Announces 2025 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comTax brackets 2025| Planning for tax cuts | Fidelity

Source : www.fidelity.comSchedule A Standard Deduction 2025 Single IRS Announces 2025 Tax Brackets, Standard Deductions And Other : There is good news from the IRS this year. The standard deduction that people are allowed to take has gone up. . For 2025, the standard tax deduction for single filers has been raised to $14,600, a $750 increase from 2023. For those married and filing jointly, the standard deduction has been raised to $29,200, .

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)